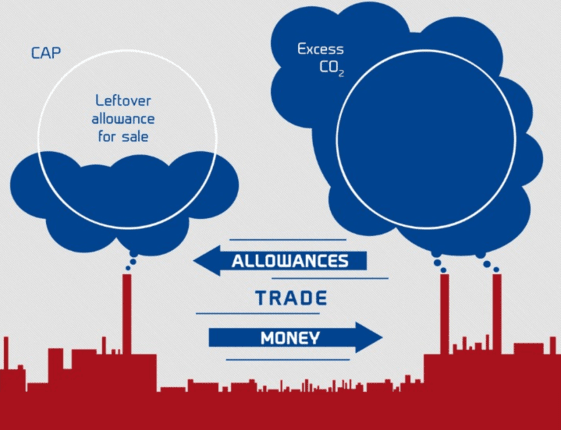

A carbon market allows investors and corporations to trade both carbon credits and carbon offsets simultaneously. This mitigates the environmental crisis, while also creating new market opportunities. New challenges nearly always produce new markets, and the ongoing climate crisis and rising global emissions are no exception. The renewed interest in carbon markets is relatively new and challenging, being complex. International carbon trading markets have been around since the 1997 Kyoto Protocols, but the emergence of new regional markets has prompted a surge in investment. The Kyoto Protocol of 1997 and the Paris Agreement of 2015 were international accords that laid out international CO2 emissions goals. With the latter ratified by all but six countries, they have given rise to national emissions targets and the regulations to back them. With these new regulations in force, the pressure on businesses to find ways to reduce their carbon footprint is growing. Most of today’s interim solutions involve the use of the carbon markets. What the carbon markets do is turn CO2 emissions into a commodity by giving it a price. These emissions fall into one of two categories: Carbon credits or carbon offsets, and they can both be bought and sold on a carbon market. It’s a simple idea that provides a market-based solution to a thorny problem. The advent of new mandatory emissions trading programs and growing consumer pressure have driven companies to turn to the voluntary market for carbon offsets. Changing public attitudes on climate change and carbon emissions have added a public policy incentive. Despite an ever-shifting background of state, federal, and international regulations, there’s more need than ever for companies and investors to understand carbon credits In a complex carbon market, we use our expertise to inform customers on how to invest their energy wisely. To achieve your net zero goals, we have created a reliable carbon registry. Enhanced by our expertise in carbon and environmental markets, we define and enact the strategy required to implement to ensure compliance and sustenance of profitable operations in the operating geographies. In Europe, the carbon credits are traded under CBAM (Cross Border Adjustment Mechanism) and are terms as EUAs.